5 Keys to Paying Off Debt After College

5 Keys to Paying Off Debt After College

When you get out of college, debt quickly will rear it’s ugly head. Paying off

debt is one of the realities that college students always dread and with

good reason. Student loans and the like can pile up and destroy a budget if

you are not careful. Fortunately, you can pay off your debts and still forge

forward in life. Here are some tips to paying off debt after college:

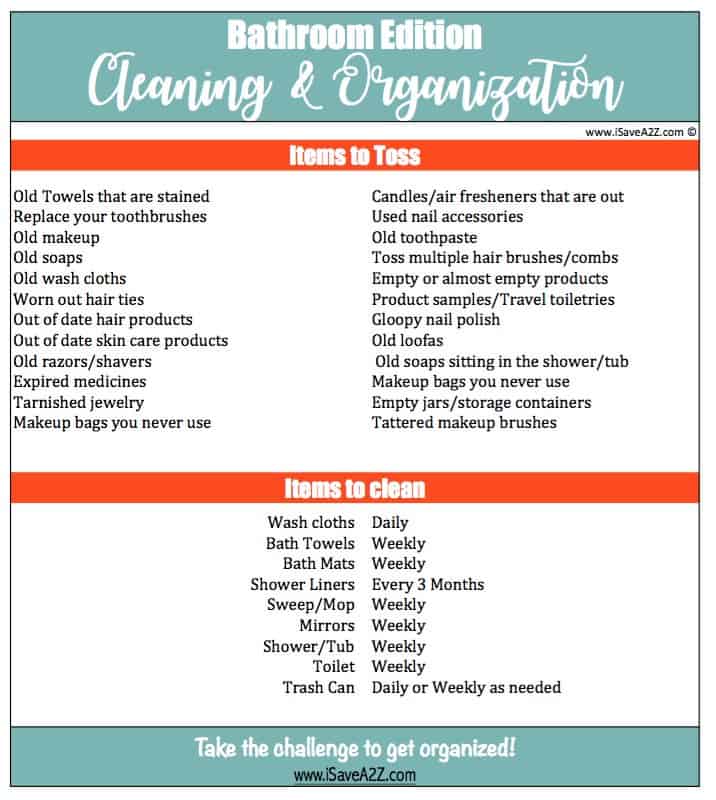

Get organized

Organization is a huge part of paying off debt and the most important really.

If you don’t know what you owe and to whom, you have little chance of

getting your debt paid down. This sounds like common sense, but

sometimes it takes several loans and creditors to get through college. This

can get confusing. Sit down and list all of your creditors and the amounts

owed. Then organize them by the amount of interest you pay.

Find out about loan forgiveness

Loan forgiveness is not available to everyone but it certainly can be an

option. If you are considering a public job such as teaching, or a

government type job that will use your schooling experience, you can

inquire about loan forgiveness. Sometimes you can have loans erased

altogether.

Investigate consolidation

Consolidation loans are a hot topic with many in the finance industry

primarily because there are so many that are scams. You can benefit from

a loan consolidation after college, but you have to be sure it is a safe one.

Check for super high interest rates before committing and make sure you

ask around and get referrals. Loan consolidation is a scary business.

Pay high interest items first

his is a huge principle to follow when you are paying off debt. High

interest will absolutely murder your chances of paying anything quickly. Get

rid of the biggest offenders first and throw minimum payments at the

others. Then move on to the next highest until you get it under control.

Understand that forbearance will still build interest

Many college students will immediately get a forbearance after school to

extend the amount of time the have before paying. What they don’t pay

attention to is the fact that interest continues to accrue. You are much

better off simply paying the minimum balance each month than to write it

off entirely for a period of time. This will pile up and make it extremely hard

to get rid of. Interest does, after all, have a tendency to compound.

Paying off debt after college is really not all that tough if you do a little

research. Take advantage of programs that are available to you and make

certain you put the money you do have to good use. If you follow these

basic principles you will be debt free in no time and ready to move on with

your career!